News

Optimising the Funding Mix: Strategies for the Scalable Retrofit for Warmer Homes

Optimising the Funding Mix: Strategies for the Scalable Retrofit for Warmer Homes.

This is a summary of the panel presentation given at Homes UK Unlock Net Zero Solutions Hub on Wednesday 27th November 2024.

The Panel of Speakers

The panel consisted of Andrew Tod, Head of Net Zero Carbon at Susreserve as Chair, Antoine Pellet, Head of retrofit credits at HACT, Tim Meanock, CEO and co-founder Tallarna, Clare Hasprey-Young, Regional Manager at Kensa, and Alexandra Rice, Commerical Officer and Unity Trust Bank.

Andrew opened proceedings by outlining there is a large gap between government funding for social housing retrofit (yet to reach £10bn) and the cost it will require to hit our net zero target for social homes (likely to be in the hundreds of billions). He pointed out that a mix of funding sources will be needed to keep driving retrofit at scale, and that each panellist is working on this challenge in a different way.

Monetising Your Retrofitting

Antoine from HACT opened the talks with a short overviews of HACT’s areas of expertise. He talked how HACT work to verify carbon impact within the housing sector, calculating the benefit of different interventions. He went on to discuss how retrofit can be monetised by housing associations or local authorities (HA/LA) through their retrofit credits programme, which also helps HA/LA to drive social value throughout retrofit projects. HACT’s retrofit credits programme started with a pilot in 2022 of 6700 homes and went onto help 15,500 homes draw down retrofit funding in 2023.

A key takeaway from Antoine is to be hyper local - developing retrofit projects and selling verified carbon credits within a LA area, and delivering local social value at the same time.

Private Funding Options

Tim followed, discussing how Tallarna works with Social Housing landlords to help them access private funding. Many HA/LAs are struggling to access private finance that works with their loan covenants. Creating a project finance shared savings model with an off-balance sheet structure helps overcome this.

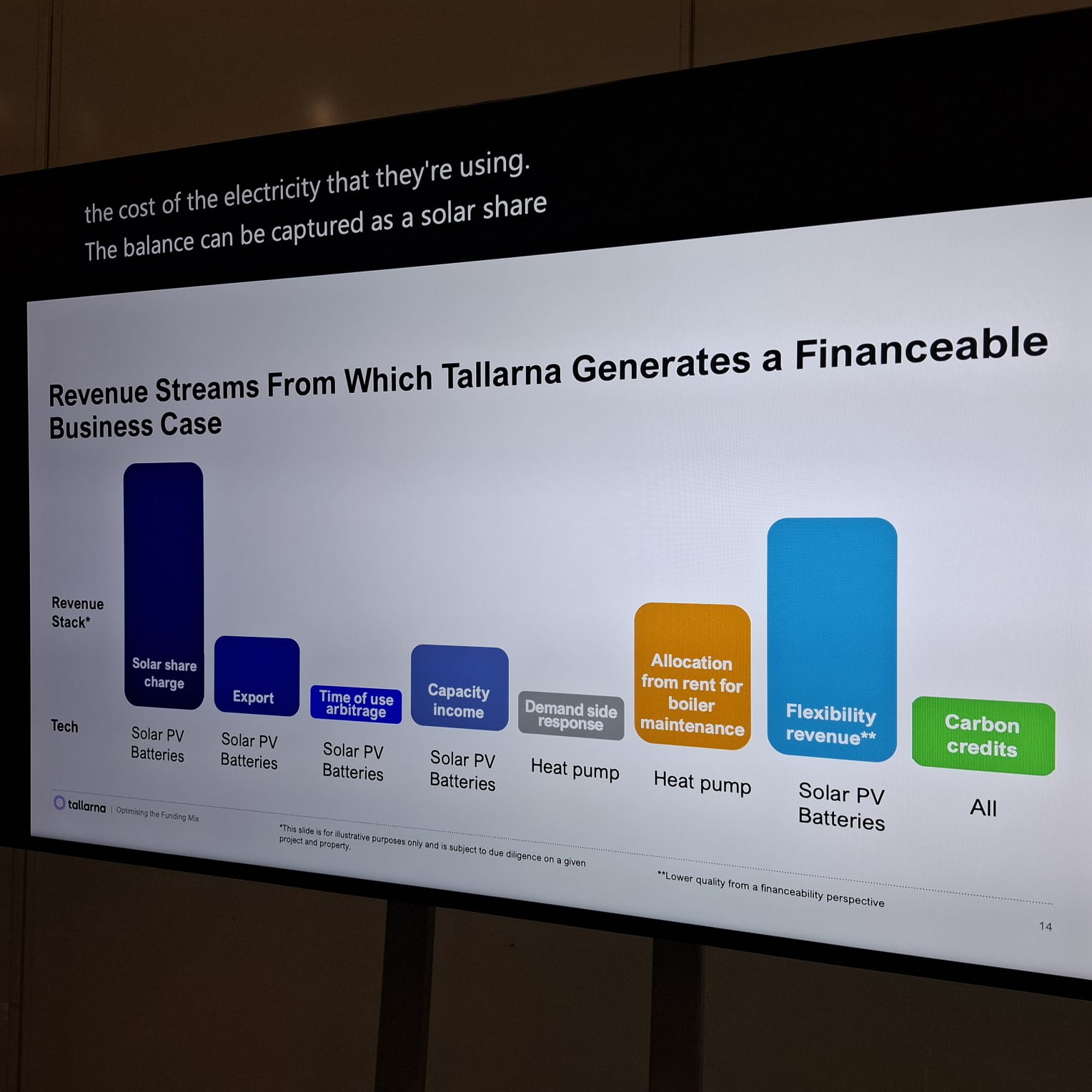

Retrofitting creates income streams that can be monetised. Some of these can be used to raise and repay project finance and some can stay with the resident from day one. This reduces landlord’s capital contribution to projects. By monetising the value created by retrofits, we can enable more projects in a community and accelerate net zero. Tim reinforced the need to calculate how these income streams will be split to enable a tangible benefit to be left with residents.

Software can help with calculating projects’ income streams. Some of these are simple, like buying power at night when it is off-peak to serve houses during day, or selling power back to the energy market. These income streams can be financed and insured, importantly over a realistic term of up to 30 years, to keep the finance off balance and not impact landlords’ covenants. Insurance is also key for protecting residents’ project savings over the long term.

How Do We Open Up Funding at Scale?

Tim said it is important to generate a business case early on. This can be done at a desktop level and is key to getting stakeholders aligned and engaged to deliver the best option for them and their residents.

Ground Source Heat Options

Clare stepped up to share the journey of Kensa who’s 25 years in business has seen them grow to deliver 50% of annual ground source heat pumps in the UK. From their UK facility they manufacture the smallest and quietest ground source heat pump on the market with heat delivered through shared ambient systems which involves bore holes to serve multiple properties.

Clare shared that Kensa has expertise in delivering project from feasibility to design and delivery of system, and additionally can provide a finance offer for HA/LA to take away the upfront capital cost. Kensa can cover all or part of the cost of the installation and charge the building owner a monthly service charge over time. These kinds of financing offer are helping to provide flexibility to housing providers in how they fund retrofit and clean heating projects.

A Social Impact Focused Bank

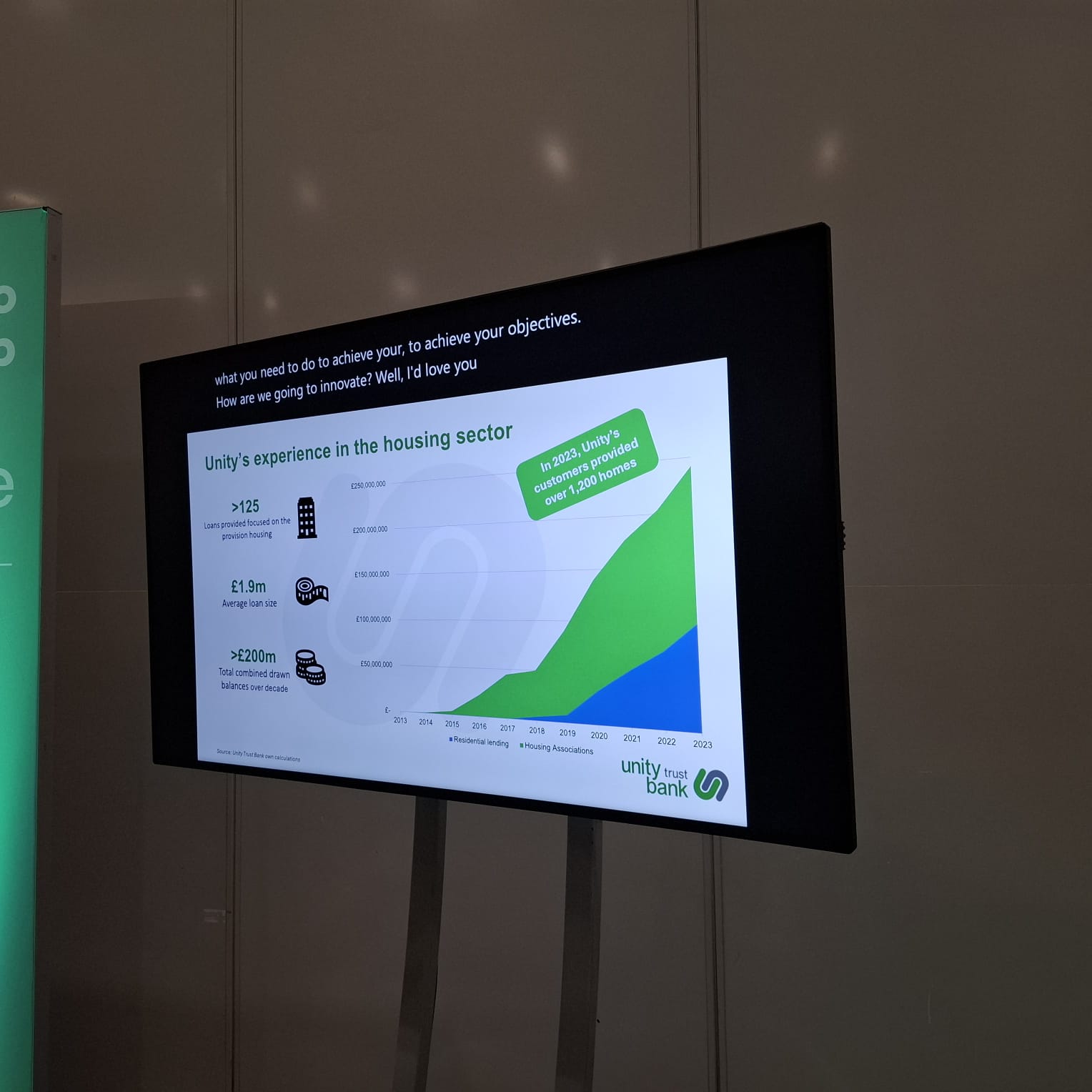

Alexandra of Unity Trust Bank shared that Unity is a different from traditional banks – it is an ethical bank that has social impact at the centre of everything it does. Unity want to be part of the solution to help communities to thrive. Their articles of association are locked into social impact lending.

Unity are supporting housing providers in their journeys to net zero, but also bringing jobs and income, into the communities the housing providers they support are operating in. Alexandra mentioned a focus on delivering and communicating tangible impact, having recently installed a Chief impact officer, and created a new role of impact proposition to support the delivery of their funding for the housing sector, totalling £200m to date.

2023 saw Unity launch a transition initiative of £25m to support LA/HA with lending of up to £5m with their decarbonisation projects, helping to provide top up finance without the painful commercial banks interest rates. As this funding is committed to community improvement the debt is charged at a more favourable rate. From 2024 and beyond Unity is planning on doubling the pot to £50m to help drive efforts towards our common goal of net zero. Alexandra emphasised the need to support clients to not overcommit and ensure that they are working in a sustainable way.

Question Time

How Do We Open Up Funding at Scale?

Tim said it is Important to generate a business case to get the right financial backing - using technology to ensure you build a case that parties can engage with to deliver the best option. Clare said good scoping is key to delivering projects at scale – and highlighted that lifecycle costs need to be modelled into decarbonisation projects to show long term maintenance spends.

Alexandra felt education is key - supporting clients to understand the implications. Although banks can’t provide financial advice, sharing knowledge is important and signposting to places that can be helpful. It was mooted that ideally one source of information shared by all around the financing options would be beneficial.

Antoine said collaboration will be key, optimising learning and sharing to help others, also showing the benefit beyond the home in addressing social inequalities, for example the health and wellbeing, how that is linked to state savings, and GDP with impact on ability to work.

Key Takeaways

Alexandra said understand what your impact will look like now and in 5,10,15 years and beyond. Cost is an important driver - be clear on your future costs

Clare reinforced that there is no risk in looking at feasibility. Gather the information, understand the process. Kensa offer free feasibility reports.

Tim suggests that normalising off-balance sheet finance will be key to delivering more retrofits at speed and scale. This is because off-balance sheet finance enables CFOs to be able to sign off on projects as it reduces landlords’ capital contribution and does not impact their existing debt. It is important stakeholders are shown this project finance opportunity in a way that is meaningful to them.

Antoine said if you are delivering any major retrofit works as a HA/LA then talk to HACT who can investigate retrofit credits for those projects.

Sureserve would like to thank the panellists for giving their time and expertise to support housing associations and local authorities working towards net zero.